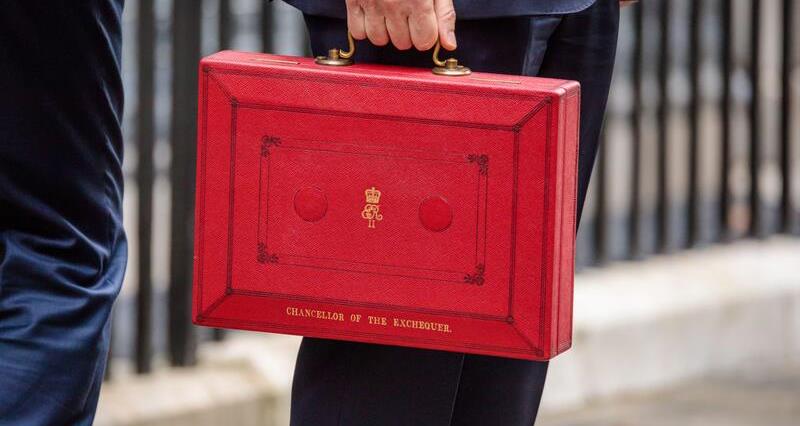

The future of UK farms is at serious risk from the proposed changes to APR (Agricultural Property Relief) and BPR (Business Property Relief), in addition to other inflationary policies within last October’s Budget, including rises to employers’ National Insurance and the National Living Wage.

It has therefore come as no surprise that the wider agri-food sector and allied industries are also questioning the impact of the Budget.

Speaking today at LAMMA, NFU President Tom Bradshaw said: “Just as family farm businesses stand to be crippled by this tax, businesses within the wider agricultural space may soon find themselves under crushing pressure too.

“Farm businesses are often the bellwether of the rural economy and many have curtailed investment on their farms because any penny they had or could have borrowed will now have to go on saving the future of the farm.”

Knock-on effect

“From builders, vets and feed merchants, to fencers, machinery dealers and tool manufacturers, there’s been talk of calls drying up and order books looking sparse for the year ahead as their customers – Britain’s farmers – face a cash flow and confidence crisis that’s been exacerbated by the family farm tax,” Tom explained.

“This shows the knock-on effect of poor policies, squeezed margins and a market not functioning properly.

“That is why we have chosen today to launch a to show they will join our fight to stop this unfair tax and secure the future of British family farming – the bedrock of the nation’s food and drink manufacturing industry – and those allied industries which rely on a thriving farming sector.”

Photograph: Simon Hadley Photography

Crunching the numbers

Independent analysis commissioned by the NFU shows that 75% of farm businesses could be impacted in some way by the family farm tax.

The CAAV (Central Association of Agricultural Valuers) were among the allied industries who showed solidarity with the British farming industry and highlighted that the government figures were highly uncertain.

Meanwhile, has shown that the changes to BPR could lead to more than 125,000 job losses, with family businesses significantly cutting investment.

Given so many of these businesses are reliant on a thriving farming sector for their own trade, they too are urging the government to reconsider the policy.

For the future of our industry

»ĘĽŇ»ŞČËPresident added: “For the future of our industry and for vital growth in the economy, I urge all businesses associated with agriculture to sign our pledge to show the government it is not too late to review plans and consider the unintended consequences of changes to APR and BPR on our sector and the wider economy.

“Changes to inheritance tax must be paused and consulted on."

Tom was joined on stage at LAMMA by Jeff Claydon, CEO of drill manufacturer Claydon, who explained how his business has been affected by the family farm tax.

“From builders, vets and feed merchants, to fencers, machinery dealers and tool manufacturers, there’s been talk of calls drying up and order books looking sparse for the year ahead.”

NFU President Tom Bradshaw

He said: “I started our family drill manufacturing business alongside our farm 20 years ago and I’m incredibly concerned the inheritance tax changes will curtail privately owned businesses and growth in family businesses.

“Without profit, you haven’t got a business. And the current policy and economic outlook means so many are seeing their profits slashed. In addition to the family farm tax, there are so many questions government still haven’t got an answer for. For our business, the indecision about the Farming Equipment and Technology Fund means orders have stalled and we’ve got warehouses of unmoved stock.

“We want growth, the government has repeatedly said it wants growth, but it must revisit its short-term plans for the agriculture industry because it is being stifled.”